India's Online Gaming Market Ripe for Investors and Local Companies

ऑनलाइन गेम के शौकीन बच्चे ने की आत्महत्या

The Union market potential and its constant digital expansion makes for a hugely attractive business climate. Online (mobile) gaming is a prime example of a segment with a growing economic and social importance.

A Boom in Gaming Demand with Room to Spare

The pandemic changed our consumption, especially in terms of digital services. Media reports on the growth of online gaming and mobile casino entertainment are not a surprise in this context. The gaming market, in particular, has become particularly appealing for investors and profitable for tech startups.

Indian and foreign companies producing gaming apps, servicing video player platforms and selling lottery tickets online have posted unprecedented numbers in the past couple of years. Valued at nearly $2 billion, Bharat is already sixth in revenue among the top-ranking global markets, leaving many European nations behind. More importantly, it is expected to reach $4 billion by 2026.

Desi Favourites Shape Contents

According to gaming industry studies, the type of contents made available on the market also reflect the cultural specifics, as gaming studios seek to maintain high engagement levels. More developed states and cities (especially the top 6 Tier-1 metro areas) provide the majority of online players and urban gaming communities still determine trends.

Lottery is till the nation's first real-money gaming choice, although it is held back by its largely paper-based nature. Calculations show that government lotteries can double their revenue and public benefit effects by simply going online. Analysts agree that large areas that do not have access to legal State lotteries are likely to look for gaming substitutes, whether online or on black markets.

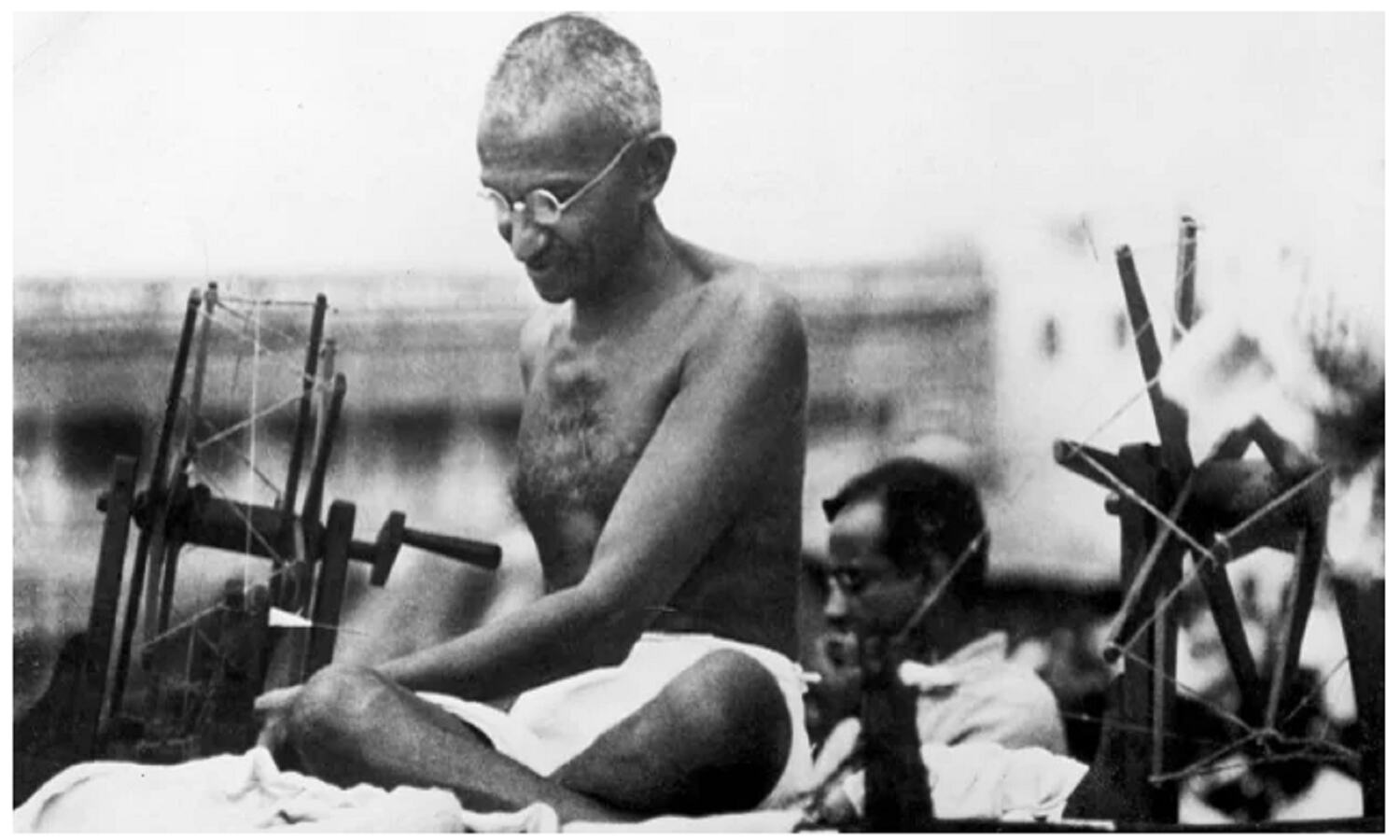

Private gaming companies are quicker to react to market demands. Desi contents and national symbols are all over the gaming apps and services currently on the market. Indian gaming studios are especially attentive to festival seasons, holidays and patriotic visual elements.

Better Accessibility Raises User Engagement

To this day, many of the top game downloads are still from foreign publishers. However, there are plenty of signs that local companies have more than a fair chance of making an impact. The growing smartphone adoption and the numerous India-based payment providers give access to online entertainment to a demographic that is wider than ever before.

Out of roughly 750 million mobile users in the Union, there are more than 400 million online gamers. Every tenth player in the world hails from Bharat and, if current growth trends continue, there will be more than 600 million gamers by 2025. While most are between 24 and 40 years of age, user groups are expanding and include more than half of working-age Indians.

The nation is also nurturing a more substantial middle class, as disposable income is quoted constantly on the rise. Urban gamer communities are more visible, inevitably, but rural consumers have also been reached by all major digital developments. This has pushed engagement levels to a third-highest in world rankings, behind China and Vietnam – an average mobile user in India spends up to 9 hours playing online games every week.

With all of these positive factors in mind, investors and tech businesses are building a healthy game development ecosystem. The local know-how, nevertheless, remains essential for ultimate success on such a particular and highly competitive digital market.